We haven't shared a lot about the Chinese game industry this past quarter, and seeing how things are moving, and you may understand why. It's maybe a broken record for many of you, but the story stays the same. "Revenue grows, top games stay on top." It's been this way for all of 2020, and with the Q1 numbers for 2021, it's doesn't seem to be changing.

But there are some interesting movement happening in the last quarter that we think is something you should be noticing, and we feel it will help you if you bring your game to the country.

How did Chinese mobile games fair?

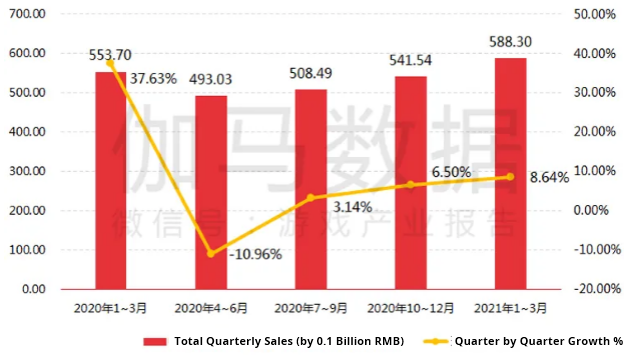

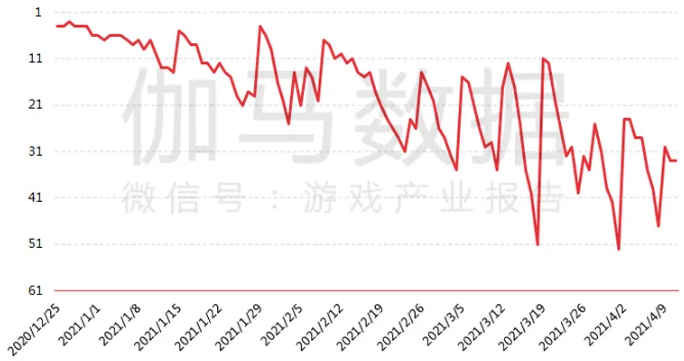

Revenue continues to grow. In Q1 of 2021, sales revenue for Chinese mobile games was 58.83 billion yuan, an increase of 8.64% quarter-on-quarter and a year-on-year increase of 6.25%

This is an 8.64% increase from the previous quarter and 6.25% from the same period last year. This growth also comes as the 3rd quarter improved after a quick dive in Q2 of 2020, which almost ended another year-on-year increase. Luckily Q3 and Q4 of 2020 helped improve the numbers.

Gamma data research shared that the increase this quarter was because there were more activities during the New Year and Spring Festival, and the number of active users increased, which brought in more money. On the other hand, last year's new products such as "Yuan Shen," "Tianya Mingyue Knife," and "Awakening of Nations" have remained high. Cash flow for new games "Tianyu" and "Angel of Glory" have injected new vitality into the market and brought growth.

Gamma data also believes the growth in Q1 of 2021 was due to the gradual improvement of the epidemic situation.

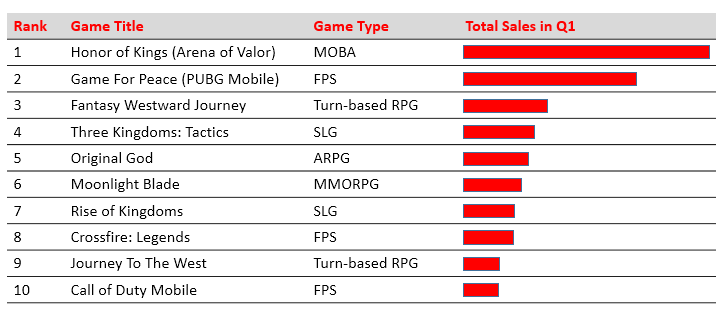

Top games continue staying on top

From January to March 2021, there are no new big players in the top 10 ranking list. Compared with the same period last year, or compared with the previous quarter, there has been little change in the list.

Compared with the same period last year, four games broke into the top 10. namely "Original God," "The End of the World," "Rise of Kingdoms," and "Call of Duty Mobile." Now that "Call of Duty Mobile" has obtained three months of revenue, it has seen a larger increase in game players after its launch at the end of December.

Cocos-built "Fantasy Westward Journey," Cocos-built "Three Kingdoms: Tactics," and "Journey To The West" have also been improving in earnings.

"Call of Duty Mobile" went live in late December, and although the iOS version rankings fluctuated, the turnover still maintained a high level. After entering March, the launch of new characters in conjunction with operating activities stimulated its ranking and increasing its rise. Holding e-sports events will play a positive role in the ecological layout of product content and commercial extension.

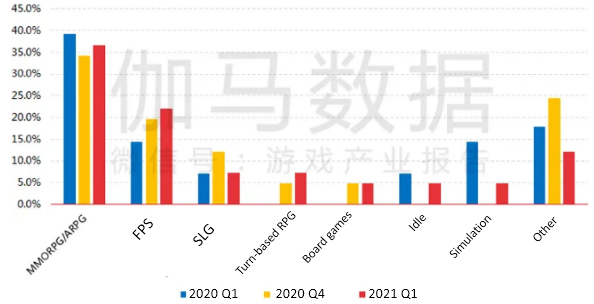

Old genres return to prominence

Q1 has seemed to become a return to the old ways of mobile gaming, having many older genres who were losing out on gamers having a reawakening and return to the top. We can see that MMORPG and ARPG have returned to growth as well as Idle games. The only difference is the growth found in FPS games in the latter part of 2020 continuing in 2021.

Quarterly product of interest: "Douluo Dalu: Wuhun Awakens"

"Douluo Dalu: Wuhun Awakens" by 37Games is a game similar to Cocos-built AFK Arena by Lillith Games.

What interested Gamma Data in their latest report was that it used a lot of small videos in social media in the first month of its launch, accounting for nearly 60% of its advertising media platform distribution.

Douyin (China's Tiktok) short videos accounted for 32.0%, and Toutiao, a Chinese news app, accounted for 24.4%. "Douluo Dalu: Wuhun Awakens" focused on the "advertising + video marketing" model in terms of advertising. Cooperating with Kuaishou, another video-sharing app has brought more significant exposure to products and more traffic to the game.