The Chinese game industry had a very turbulent time for the end of 2021. Not only did we have another hold on new games releases in the last half of the year, but child game time requirements for WeChat mini games and other games kicked in, and significant game purchases from the west held Chinese companies to hold back on acquisitions.

This end of 2021 review compiles the end-of-year report given to us by Gamma Data and will share some interesting trends that might hit in 2022 and a few companies you should look into as the powerhouses of the Chinese game industry. This article hopes to compile all of this from our good friends at Gamma Data, a company that works closely with the Chinese government to do research in the game industry in the country and shares it on their WeChat channel.

Instead of rambling on with my feelings now, let's directly get into the data, and I'll share some insight there:

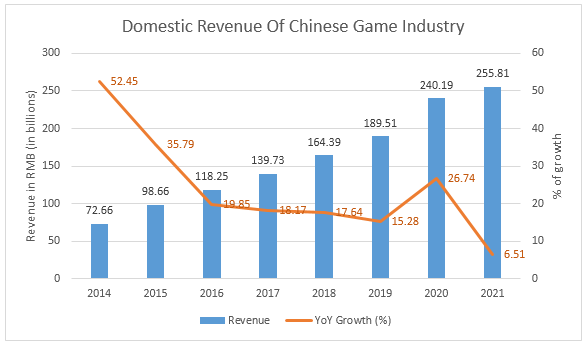

China's game industry continues to grow, slowly

This year continues the dramatic rise of the Chinese game industry, ending at 296 Billion RMB (~46 Billion USD) with an increase of 6.4% YoY.

Other than 2020, when the pandemic left many inside to play games, since 2018, the game industry has been growing from 5 – 10% leading to slower growth coming in the future. This trend is compounded by the number of gamers in the market slowing tremendously from 664.7 million in 2020 to 666.2 million in 2021, a 0.22% growth from last year. The growth of game players has been getting less than 6% growth in the past 7 of 8 years. (2018 having 7.28%)

New Trend Continues To Be: Acquire, Stay Domestic, Look Abroad

For the first time in eight years, the Chinese domestic revenue missed its double-digit increases this past year. This could be due to many factors, including a lack of new games due to regulations, Child gaming policies, and other factors.

Because of the tightening of regulations, it has pushed many game companies to either make games for international audiences or a large acquisition trend by companies like Tencent, Bytedance, and NetEase of western companies. Still, the large percentage of revenue is coming from domestic players.

This is easier to see with this chart:

| Year | % of Revenue from Domestic Players |

|---|---|

| 2014 | 63% |

| 2015 | 70% |

| 2016 | 71% |

| 2017 | 68% |

| 2018 | 76% |

| 2019 | 82% |

| 2020 | 86% |

| 2021 | 86% |

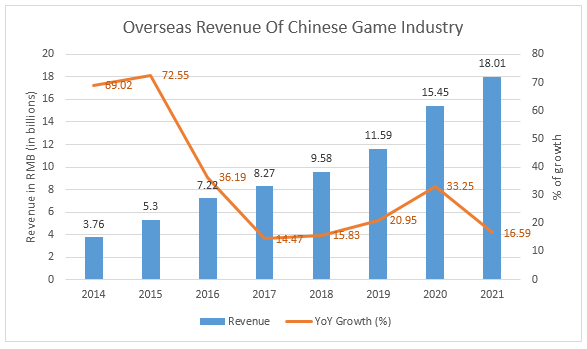

Because of movement with overseas continuing to grow, there is still double-digit growth with overseas revenue with 2021 ending with 18 billion RMB (~2.8 billion USD), a 16.59% increase from last year. This comes after a substantial 33.25% increase in 2020.

Investments from Chinese investors also grew quickly to 209 major investments totaling 25.88 billion RMB (~4.07 billion USD) in 2021. Many of these companies were over 3 years old, ending a trend of investing in very young companies (<3 years old) and a push for more towards investing into more mature game companies.

Looking at the top ten investors this past year, it's been bustling. Tencent, whose investments dwarf its competitors, has dealt with over 129 total investments. This shows that an estimated 45 billion dollars were paid out in 2021 from the top ten.

Top 10 Game Company Investors

| Company | # of investments | Investments (in billions RMB) |

|---|---|---|

| Tencent | 129 | 41.46 |

| Bilibili | 30 | 1.51 |

| G-bits | 19 | 0.45 |

| Netease | 15 | 1.26 |

| 37 Entertainment | 14 | 0.25 |

| Bytedance | 14 | 0.29 |

| Kingnet | 12 | 0.06 |

| CMGE | 8 | 0.52 |

| Xiaomi | 6 | N/A |

| IGG | 5 | 0.001 |

What were gamers playing?

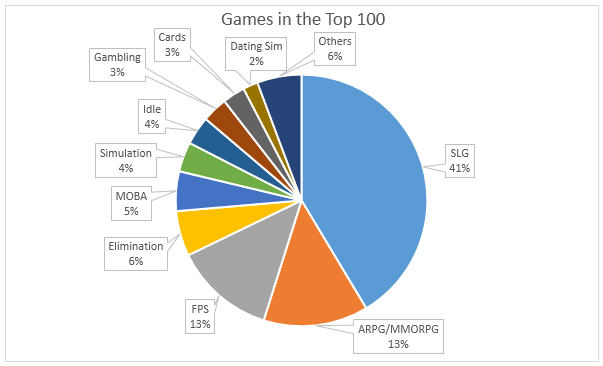

Gamers continued to put SLG games in the lead with ARPG/MMORPG on the back burner. This year, the most significant trend was the growth of more sophisticated games, with these games starting to build an audience in 2020 continuing to grow in 2021. But even with this trend, the numbers still share an all too familiar market share compared to years before. But 2022 looks to make a change to this chart.

Top 10 trends in 2022 – 4 big ones, 6 small ones

Gamma data shared a great article this January, looking into the future of the year. They gave us ten predictions that we all should be looking at:

Talent competition escalates

Talent in technology has always been a hot commodity. The fights over great talent have been hot in China, but it intensifies as the requirements for better games have increased. This has allowed for higher wages in the past 3 years, reaching an increase in salaries by 20% - 33% in some job titles.

Cost of traffic means improving user acquisition

With a lot happening to hinder how marketing is done on mobile games this past year, it's getting more expensive to gain users. Therefore, according to Gamma Data, we'll have to see much better acquisition campaigns than those we saw in the past. But for me, this has been an issue for everyone around the world.

More game genres will immerge in the top 100

In the past five years, the number of games types entering China's top 100 has steadily increased. Gone are the days of just 3 or 4 genre types fighting in the country. Last year, over 23 different game genres were found in the top 100 games chart. This is excellent news towards the market's maturity as gamers start to look for different games that suit their interests and make for some more creative games for the future.

Improved quality for more mature genres

A term I use to talk to game developers in China has always been "Don't bring your buckets to the same well everyone uses" This would mean there is only so much water in a well before it goes empty and needs time to refill. If everyone is using it, there's less water (revenue) for you to pull up.

As the companies are moving on to new genres, these wells are starting to fill back up, but only those with the highest quality buckets are getting the water, according to Gamma Data. So look for a jump in quality for many mature genres like MMORPG, ARPG, Strategy, and other genres that have been a mainstay in China for many years.

More overseas development

Chinese games entering the global market have been seen double-digit increases in revenue for a long time, with this past year having 18 billion RMB (~2.83 billion USD) coming from them, an increase of 16.5% from 2020. Most of this money is coming from strategy games. But there is a move towards adding more puzzle-based games and MMORPG/ARPG games to the west.

From a western eye, they may be on to something. Puzzle games are still a big moneymaker in the west. But for MMORPGs to grow in the future, there will have to find something as exciting as Genshin Impact to see anything of good growth to the west.

Better and new IP

IP still is growing, but looking at the numbers shared by Gamma Data, it's not keeping up with the new savvy gamers in China who are catching onto the "skinning" of games and starting to look for games with different gameplay styles and techniques. So we may see a lot more new types of characters, stories, and gameplay this year than we traditionally see used, such as Chinese history or famous Chinese novels.

Find key advantages for your game

Continuing from the last trend of new IP, games that are finding more exciting and different looks and experiences that you can push in marketing are growing. Games using different types of gameplay, art styles, themes, and mixing genres are finding more significant success in China. So looking for what makes your game different will be a crucial factor in improved sales this year.

One good example is the 2020 game "The Marvellous Snail" (built using Cocos), an idle game with a unique art style and a very humorous story that people seemed to enjoy, making it a big hit. Another from 2021 is "Hundred Scenes of South of the Yangtze River, " a simple city management game that is drawn in the style of ancient Chinese paintings.

Cloud Gaming

Cloud gaming and the appeal of a metaverse continue to be on Gamma Data's minds as they can see a time when this trend will grow even larger in the country. With talk of Fortnite by Epic Games and Roblox making big money in the west, it's something to look forward to but still has a long way of moving. These types of GAAS and GAAP games struggle to find ways to improve at a speed and quality compared to western counterparts. Though some examples like "Games For Peace" have shown it's becoming possible in China.

NewZoo worked with Gamma Data to find the three most significant issues currently facing these new types of games in China and worldwide. They are: Better content auditing and IP management, improved players' privacy while staying open world, and improving the scalability of metaverses.

Console gaming

With the official introduction of the Nintendo Switch in 2019, the increased interest in console gaming has grown, with both Sony and Microsoft bringing their newest consoles officially to the Chinese gamer. This seems to be a trend that will continue to grow as more people see gaming consoles at malls, e-shops, and other places and are amazed at the quality of games they can play off their TV.

Though Gamma Data doesn't see 2022 as the boom of console gaming, it undoubtedly exceeded sales as they saw a 20% increase in 2021 to an estimated 2.58 billion RMB (~407 million USD). It's a piece of great news to share for the future.

Growth in Casual games

Growth may continue with casual games as revenues increased by 17% last year, hitting 3.4 billion RMB (~530 million USD). Cocos has been excited about this as we've seen some tremendous growth in the quality of WeChat mini games that are now making casual gaming on the app a lot more fun and seeing many casual games getting word of mouth this past year.

So we may see a continuation of the trend, but this might be the weakest of the ten predictions as you never know what games will dominate the market this next year.

Top Brands Are Growing in China

We end this report by sharing a few companies that were seen as having high reputations in the industry in 2021, and I think you should be aware of this for the upcoming year. These include:

- Perfect World

- 37 Entertainment

- Shengqu Games

- iDreamSky

- Duoyi

- CMGE

- Happy Elements

- TanWan

- Tencent Games

- Netease

- MiHoYo

- Lillith Games

- Bilibili

- Seasun Games

- G-bits

- X.D. Network (Owners of TapTap)

These companies were shown to have improved in user satisfaction, corporate innovation, product quality, transparency and integrity, brand image, and user service.

The good news about these and other game companies in China is that the reputation of the whole industry has improved. There is an increase in branding and talent training, a considerable requirement for larger companies to keep and maintain good talent at the companies.

You can read up more about some of these companies in Gamma Data's full report here: https://mp.weixin.qq.com/s/WXsz28g3lIyHJZVAKu5glQ

Final Thoughts

In the end, we are hitting a new and exciting age for gaming in China. Not only with the way young people will play games, but the quality and size of the games. With more gamers on their phones wanting the same AAA experiences they see on consoles and PC, this has led development to another point of maturity in building these games not seen since the days after World of Warcraft. We have already seen that with a few significant games on mobile devices and a few AAA game titles coming to the consoles built directly in China coming to the west.

So for the future, the question is, are the tools for these ready? For Cocos, we knew this day was coming and have been working hard to prepare a game engine for the advancement of 3D games on mobile devices, not only for the new phones but for phones with lower-end specs that are a majority of the Chinese market—making sure that gamers can play on whatever phone they have. This includes those playing HTML5 web games, mini-games on WeChat, and mobile game platforms like HarmonyOS.

So the future looks bright, and with our upcoming upgrades to Cocos Creator, it's going to get even brighter. Just watch what we'll share this year.